Connecting the Dots: Pharmacy Involvement in Revenue Cycle

Pharmacy Revenue Cycle Podcast

Release Date: 12/28/2021

The Heavy Hitters for July Quarterly Updates

The Heavy Hitters for July Quarterly Updates

Pharmacy Revenue Cycle Podcast

July 2023 is here and time to validate another round of quarterly updates from CMS. The JZ modifier, in addition to the JW modifier, is now required to effectively bill for drug waste (JW) and to attest when no drug was discarded (JZ) for all separately payable that are single-dose or single-use containers. Additionally, we have updated the Visante Quarterly Update Tool and the C9399 Tool to help organizations validate that their system is up to date with the recent changes.

info_outline Beat Inflation with a Part B Rebate

Beat Inflation with a Part B Rebate

Pharmacy Revenue Cycle Podcast

As a part of the Inflation Reduction Act of 2022, CMS is requiring manufacture rebates for certain Medicare Part B drugs in which the cost has exceeded inflation. Beneficiaries out of pocket costs will be reduced to 20% of the inflation-adjusted payment described in the Act.

info_outline Don’t be “SAD”... An Alternative Way to Handle Self-Administered Drugs

Don’t be “SAD”... An Alternative Way to Handle Self-Administered Drugs

Pharmacy Revenue Cycle Podcast

Self-administered drugs (SAD) have been a long-standing controversy when administered in a hospital outpatient setting from the perspectives of a patient, frontline healthcare workers, and billing. “Why does my Tylenol cost $10 per tablet, but the 1,000-count bottle I have at home was purchased for $3?” This question is often difficult to answer and may lead to unintended operational consequences.

info_outline Botulinum toxin PA – Are you exempt?

Botulinum toxin PA – Are you exempt?

Pharmacy Revenue Cycle Podcast

The new year brings a new focus on resolutions including prior authorization processes. In July 2020, Medicare implemented a prior authorization process for select services including botulinum toxin. Its time to revisit workflow processes and, if not exempt, confirm with respective teams that a prior authorization is obtained prior to providing the service.

info_outline Designer HCPCS Codes are in the Mainstream Spotlight

Designer HCPCS Codes are in the Mainstream Spotlight

Pharmacy Revenue Cycle Podcast

The Pharmacy Revenue Cycle is starting out with a new fashion design for 2023 as there are 36 new brand-specific HCPCS codes. CMS has been reviewing its approach for assigning for drugs that have been approved under the Food, Drug and Cosmetic Act 505(b)(2) New Drug Application (NDA) or the Biologics License Application (BLA) after October 2003. These drugs are not rated therapeutically equivalent to the reference drug listed in the FDA’s Orange Book and therefore are considered single-source products according to section 1847A(c)(6) of the Social Security Act. Each single source product...

info_outline Hospital Outpatient Prospective Payment System (OPPS) Final Rule- CY2023

Hospital Outpatient Prospective Payment System (OPPS) Final Rule- CY2023

Pharmacy Revenue Cycle Podcast

The Centers for Medicare & Medicaid Services (CMS) provided the OPPS Final Rule for CY2023 in the Federal Register on Provisions in this rule will be effective for dates of service on or after January 1, 2023. Significant changes for drug reimbursement and coding occur in three areas: 340B-acquired drugs, non-opioid pain management reimbursement in Ambulatory Surgery Centers (ASC) and Hospital Outpatient Departments (HOPD), and new requirements for reporting waste in HOPD. 340B-acquired Drugs In light of the Supreme Court decision in American Hospital Association v. Becerra, 142 S. Ct....

info_outline Drug Waste is Packed with a Punch and a Refund

Drug Waste is Packed with a Punch and a Refund

Pharmacy Revenue Cycle Podcast

Dive into the CY23 CMS Physician Fee Schedule rule as it relates to the new requirements for discarded drugs or drug waste. A JW and JZ modifier are required for all Part B separately payable single-dose or single-use packages. Additionally, manufacturers are required to pay a refund for discarded drugs that exceed 10% of the total charges.

info_outline Payment Increases for Biosimilars

Payment Increases for Biosimilars

Pharmacy Revenue Cycle Podcast

Payment Increases for Biosimilars On April 16th, 2022, the Inflation Reduction Act of 2022 was signed into law. Section 11403 requires a temporary increase in add-on payment for qualifying biosimilars from 6% to 8% for 5 years. This change was implemented on October 1, 2022, and CMS uploaded pricing files that already include the temporary price increase. Applicable 5-year period This increase began on October 1, 2022, for products for which payment was made by September 30, 2022. For other biosimilar products in which payment was made between October 1, 2022 - December 31, 2027, the 5-year...

info_outline Car T-cell Therapy: Coverage and Billing-Outpatient (Updated – October 1, 2022)

Car T-cell Therapy: Coverage and Billing-Outpatient (Updated – October 1, 2022)

Pharmacy Revenue Cycle Podcast

Chimeric Antigen Receptor (CAR) T-cell therapy is an example of a rapidly emerging immunotherapy approach called adoptive cell transfer (ACT) where patients’ own immune cells are collected and used to treat their cancer. This newsletter details coverage and billing instructions when the products are used on an outpatient basis and has been updated to reflect HCPCS codes current as of October 1, 2022. The Center for Biologics Evaluation and Research (CBER) of the Food and Drug Administration (FDA) regulates cellular therapy products, human gene therapy products, and certain devices related to...

info_outline Vacating the 340B Payment Reduction Policy

Vacating the 340B Payment Reduction Policy

Pharmacy Revenue Cycle Podcast

On September 28, 2022, the US District Court issued a that states the Department of Health and Human Services (HHS) is required to vacate the prospective portion of the 340B reimbursement rate outlined in the 2022 Outpatient Prospective Payment System (OPPS) Rule. In other words, payment rates must revert to the default of ASP + 6% rather than the reduced rate for select drugs of ASP - 22.5%. The decision was determined to not cause substantial disruption; thereby, requiring HHS to begin immediately. This was in response to American Hospital Association v. Becerra, 142 S. Ct. 1896 (2022), in...

info_outlineIt may seem like unnecessary work to review the items on our Quarterly Checklist each quarter to identify changes and updates. Some tasks may be delegated to other groups such as Chargemaster Managers or Billers, but for one task, pharmacy is the best department to “connect the dots”: Restated Payment Rates.

Our “action to take” recommendation is: “Map restated payments to the effective quarter, determine impact, and rebill as necessary.” We believe that the pharmacy department is in the best position to take this action and in some cases, increase pharmacy revenue. Let’s walk through an example in more depth.

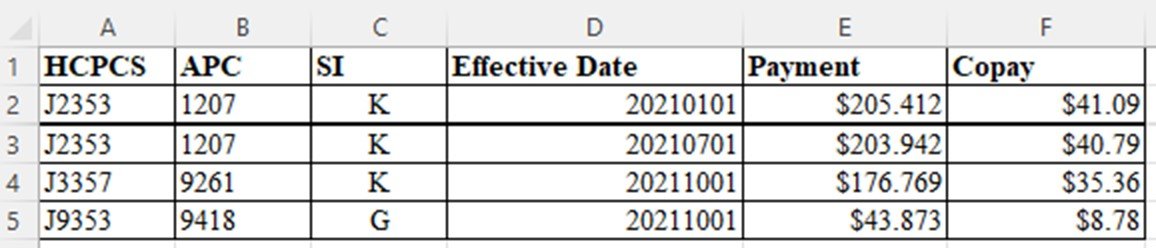

As noted on our Quarterly Checklist, CMS posts “restated payment rates” each quarter. For January 2022, the file has this information:

Here are the steps to process this file to determine impact:

1. Review Addendum B for the appropriate quarter to determine what the posted payment rate was. Since the “payment” column includes the “copay”, it is only necessary to add the payment column from the previous quarter.

2. Calculate the payment difference.

3. Add the “short descriptor” from Addendum B to determine the HCPCS code dose amount.

4. If the “short descriptor” from Addendum B does not include the HCPCS code dose amount, go to the Alpha-Numeric HCPCS File on the HCPCS Quarterly Update page to retrieve the “long description”. Use the HCPCYYYY_MMM_ANWEB_vN.xlsx file.

5. Add prescribing information and calculate the average adult dose using 100 kg or 3M2 for BSA. For every 3 week regimens use 5 potential doses; for every 4 week regimens use 4 potential doses (assumes patient received first dose on first day of quarter).

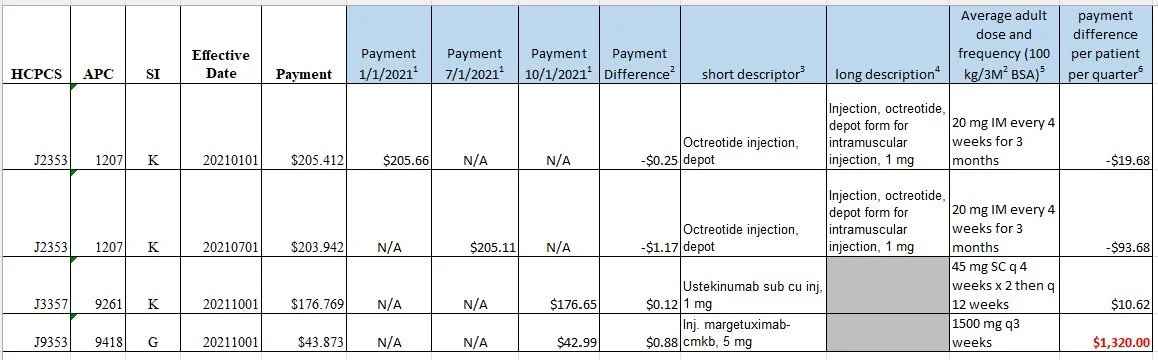

6. Calculate the average payment difference for one quarter for one patient to determine financial impact of restated rates. In consultation with the Finance Department, Pharmacies should establish policies as to which payment difference amounts are “significant” to determine rebill potential. (In our example for January 2022, some providers would consider the $1320.00 to be significant and review accounts with HCPCS code J9353)

7. When rebill thresholds are met, Pharmacy should estimate the total change in revenue based upon actual patient usage and review potential rebills for the quarter with Finance to obtain authorization for rebilling. (Timely filing for Medicare is one year from date of service but rebills should be generated as soon as authorized).

8. Managed Care Contracting group should be notified to determine if any managed care contract payments are based upon Medicare rates and if rebilling of any commercial/Medicare advantage accounts is warranted.

9. Your completed analysis for finance review will look like this:

SHOUT-OUTS

1. The Department of Pharmacy is in the best position to evaluate restated payment rates for drugs each quarter and provide information to Finance for potential rebilling opportunities.

2. The Finance Department should determine in advance a “payment threshold difference” which is considered “significant” to warrant further investigation into rebilling opportunities.

3. The Managed Care Contracting group should be notified if any HCPCS codes are selected to be rebilled to determine if any Commercial/Medicare Advantage payments are similarly impacted and to determine if those accounts should similarly be rebilled.

Our goal is simple; we’re taking complex information and making it practical.

Until our next edition, this is Maxie Friemel and Agatha Nolen providing you with tips for increasing your Pharmacy Revenue.