616: Common COGS Misconceptions Related To Construction

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

Release Date: 02/21/2025

642: How To Know If It's Time To Raise Your Rates Without Losing Clients

642: How To Know If It's Time To Raise Your Rates Without Losing Clients

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 642, And It's About How To Know If It's Time To Raise Your Rates Without Losing Clients A Practical Guide for Contractors Who Want to Stay Profitable—Without Scaring Off Business If you're like most small construction business owners, you've probably had this thought: "I'm working non-stop, but I'm still barely keeping up—should I raise my prices?" And then right after that, the fear kicks in: "What if I lose clients? What if no one can afford me anymore?" As construction bookkeeping specialists, we hear this frequently. Contractors are nervous to raise their...

info_outline 641: A Week In The Life Of A Profitable Contractor- Habits That Pay Off

641: A Week In The Life Of A Profitable Contractor- Habits That Pay Off

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 641, And It's About A Week In The Life Of A Profitable Contractor- Habits That Pay Off If you're a small construction business owner, you know what it feels like to be busy but not consistently profitable. You're running from job sites to supply runs to client meetings, answering calls at night, and still wondering where the money went at the end of the month. Here's the truth we see every day as construction bookkeeping specialists: The most successful contractors aren't just working harder—they've built weekly habits and systems that keep the business running while...

info_outline 640: How To Build Systems That Support Your Construction Business

640: How To Build Systems That Support Your Construction Business

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 640, And It's About How To Build Systems That Support Your Construction Business Turning the 3 Pillars—Marketing, Accounting, and Production—Into Repeatable Routines(without adding more work) You've done the hard part—you're running a construction business, getting jobs, and turning out quality work. Perhaps you've even begun to refine your marketing, job costing, and project delivery strategies, thanks to the three pillars we've discussed: Attracting the Right Jobs, Controlling the Money, and Delivering Projects Profitably. But here's the next step that will...

info_outline 639: Pillar 3 - Delivering Construction Projects Profitably

639: Pillar 3 - Delivering Construction Projects Profitably

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 639, And It's About Pillar 3: Delivering Construction Projects Profitably A Construction Bookkeeper's Guide to Smarter Production for Small Contractors You've done the hard work: marketed your services, landed the job, and priced it to make a solid profit. But here's where a lot of small construction businesses lose money—even after doing everything right up to this point. That moment is project execution—or what we in the business world call production. As construction bookkeeping specialists, we've seen many jobs transition from profitable to painful...

info_outline 638: Pillar 2: Controlling The Money - Construction Accounting And Bookkeeping

638: Pillar 2: Controlling The Money - Construction Accounting And Bookkeeping

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 638, And It's About Pillar 2: Controlling The Money - Construction Accounting And Bookkeeping How Smart Money Management Keeps Your Business Profitable and Stress-Free When most small construction business owners think about success, they envision a steady stream of jobs, high-quality work, and satisfied clients. But there’s another side to the story that often gets ignored: the financial health of your business. And here’s the truth we see every day as construction bookkeeping specialists: Even skilled contractors with full calendars can run into cash flow...

info_outline 637: Pillar 1: Marketing - Attracting The Right Construction Jobs

637: Pillar 1: Marketing - Attracting The Right Construction Jobs

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 637, And It's About Pillar 1: Marketing - Attracting The Right Construction Jobs A Guide for Small Construction Business Owners (from Your Bookkeeper's Point of View) As construction bookkeeping specialists, we spend a significant amount of time analyzing the numbers behind small construction businesses—everything from job costs to cash flow to profit margins. However, here's the truth most contractors don't hear enough: Your profitability starts before the job even begins. Yes, it starts with the jobs you say yes to—and more importantly, the ones you should start...

info_outline 636: The Three Pillars Of A Profitable Construction Business

636: The Three Pillars Of A Profitable Construction Business

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 636, And It's About The Three Pillars Of A Profitable Construction Business Running a small construction business is no small feat. You're on job sites one minute, sending invoices the next, and trying to line up your next project after that. It's a constant juggling act—and without the right systems, it's easy to fall behind or burn out. As construction bookkeeping specialists, we work with small contractors who are incredibly skilled in their trade but often feel overwhelmed when it comes to running their businesses. And over the years, we've noticed a pattern:...

info_outline 635: The #1 Reason Contractors Lose Clients: Poor Invoicing—And How to Fix It

635: The #1 Reason Contractors Lose Clients: Poor Invoicing—And How to Fix It

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 635, And It's About The #1 Reason Contractors Lose Clients: Poor Invoicing—And How to Fix It As we celebrate Independence Day and the spirit of hard work and craftsmanship that built our country, it’s the perfect time to think about strengthening your construction business, so you have the freedom to grow and succeed. When most contractors consider why they lose clients, they often blame price competition, slow projects, or a client’s unrealistic expectations. But in my experience as a construction bookkeeper, one of the most common—and preventable—reasons...

info_outline 634: Financial Red Flags Your Construction Company Can't Afford To Ignore

634: Financial Red Flags Your Construction Company Can't Afford To Ignore

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 634, And It's About Financial Red Flags Your Construction Company Can't Afford To Ignore As a construction bookkeeper, I've had a unique vantage point, watching countless projects unfold from the first bid to the final payment. While the hammers and blueprints are the visible signs of progress, it's the numbers behind the scenes that truly tell the story of a company's health. And let me tell you, those numbers often whisper warnings before they start screaming. Small business owners in the construction industry are incredibly busy. You're juggling bids, managing...

info_outline 633: Cash Is King But Do You Have A Crown? Why Cash Flow Trumps Profit

633: Cash Is King But Do You Have A Crown? Why Cash Flow Trumps Profit

Contractor Success Map with Randal DeHart | Contractor Bookkeeping And Accounting Services

This Podcast Is Episode 633, And It's About Cash Is King But Do You Have A Crown? Why Cash Flow Trumps Profit

info_outline2. What are the components of COGS?

COGS isn't one-size-fits-all. It includes different types of costs depending on your business.

Here are the main components typically included in COGS:

- Materials: Raw ingredients or parts used to provide your service

- Payroll: The wages you pay to employees directly involved in production

- Manufacturing Overheads: Indirect costs required to produce services, such as equipment depreciation or utility costs.

Note

General overheads, such as office or marketing costs, are not included in COGS—only expenses tied directly to production count.

3. How do I calculate COGS?

Fortunately, calculating COGS follows a straightforward formula:

COGS = Beginning inventory + Purchases during the period – Ending inventory

Breaking it down:- Beginning inventory: The inventory value on hand at the start of the accounting period.

- Purchases: All costs for new inventory bought or manufactured during the period.

- Ending inventory: The value of unsold inventory at the period's end.

Example Calculation

Imagine you run a small boutique that sells handmade gifts. If:

- Your beginning inventory is $5,000,

- You spent $8,000 on materials and production, and

- Your ending inventory is $2,000,

Then your COGS would be:

$5,000 + $8,000 – $2,000 = $11,000

This $11,000 represents the cost of creating the products you sold during the period.

But wait - that is for a retail business. Simple. What about construction?

Direct Costs are tied to the jobs (field labor, materials, and other cost items). Office materials (pencils, paper, toner, etc.) are overhead. Yes, an accountant could say these many pencils are used in the field and that notepad is used in the truck.

The answer is the dividing line of the direct costs to the job: the Costs of Goods Sold (COGS).

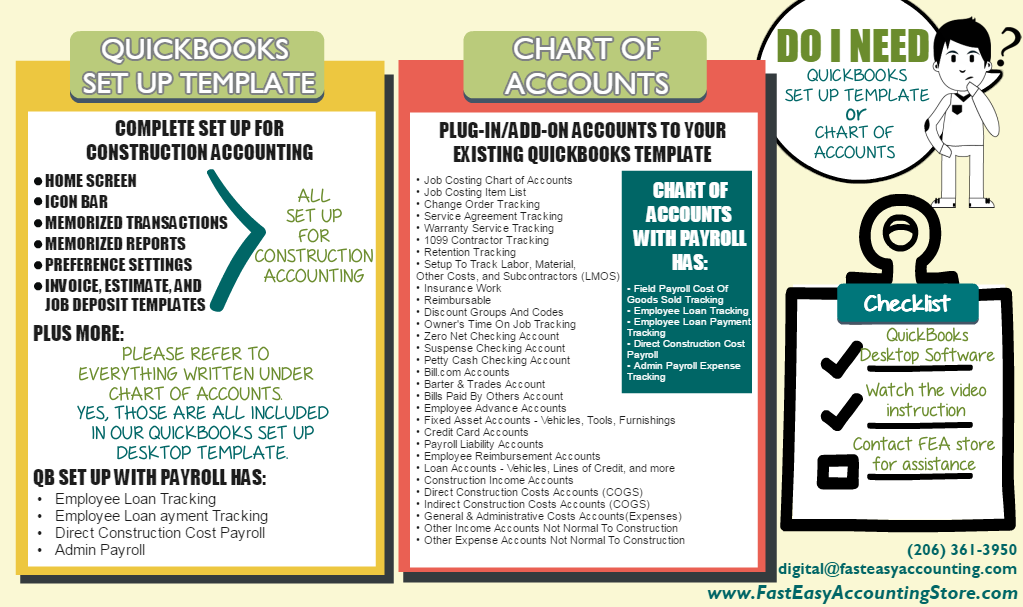

That is why we've created our Chart of Accounts, which you can use inside QuickBooks, depending on your type of construction business.

Most COGS accounting methods you will find are for inventory valuation, which is confusing to most contractors.

Confusion always arises about the material. A construction contractor may purchase material and resell it to their customer at cost, thinking it is a reimbursable expense. (You lose money when doing this.)

Remember, all invoices to the Customer (Retail, General Contractor, Spec Builder, Developer) are income. Washington State has a clear explanation. If the words are on the invoice, then the invoice is either taxable or non-taxable based on other factors. Every line item on a customer invoice is income.

Purchases for the material are the Cost of Goods Sold or expenses if you are short-cutting your accounting. I have seen financial statements backed out because they will reflect reimbursable income as a negative number, thereby showing it as a deduction. (The net effect is double-dipping on the expense side.) The cause is that the accounting software is not being correctly set up. We fix bad QuickBooks setups for Construction Contractors.

New Construction Home Building is another area of confusion. In the mind of many construction contractors, a Spec home is any new house being built for resale. That is true; it is a New Construction House. The question is on the construction accounting side. For the Owner and Developer (who might be the General Contractor running the job), it is a Spec Home.

For the General Contractor who is building a New Construction Home for a Developer, it is NOT a Spec Home. Why might it seem the same as both are New Construction Houses? The question to be answered is, "Who owns the house?" - It is a Spec House in the accounting system for THE OWNER.

If the General Contractor does not own the house, then from the accounting side for that specific General Contractor, the house is a Custom Home with an owner who is not the General Contractor.

Suppose the General Contractor or developer owns the new house being built. In that case, it is a Spec House in the Accounting System. All costs roll up into WIP (Work-In-Process) and convert to COGS when the house is sold, not before. Recognize expenses when the home sells. Otherwise, expenses one year and sales the next equals taxes.

In Washington State, all construction contractors working for a spec builder must collect sales tax on all services (labor and material) when billed by the general and trade construction contractors.

In Washington State, all Construction Contractors working on Custom Homes, Residential or Commercial Projects, large or Small Remodels, or Handyman Projects can accept a reseller permit from the General Contractor. The general contractor bills and collects sales tax from the Owner.

In Washington State, Contractors must collect sales tax on all retail projects, including Labor, Materials, and others. Sales tax must be collected on every line item. Customer Discounts can be given for any reason.

And that is just for one state.

Pro Tip

Consult with your accountant to identify the best method for your business—tax implications vary by approach.

4. Why does understanding COGS matter?

Knowing your COGS is a game-changer for managing and growing your business. Here are some ways it benefits you:

- Profitability analysis - COGS is crucial for calculating gross profit. Subtracting COGS from revenue reveals how much your products contribute to your bottom line.

- Pricing strategy - Understanding how much a specific project costs allows you to set prices that cover expenses while leaving room for profit.

- Financial reporting - COGS is necessary for accurate income statements and tax reporting. It also demonstrates operational efficiency, which is key for attracting investors or securing loans.

- Tax benefits - COGS are deductible, reducing your taxable income. The more precise your calculations, the better-positioned you'll be during tax season.

5. How can your accountant help

Managing COGS can be complex, but you don't have to go through it alone. Your accountant is your best ally when navigating this process.

They can:

- Help you set up your Contractor Chart of Accounts

- Ensure all eligible expenses are accounted for (and not missed!).

- Revise your tax strategy while staying compliant with regulations.

One of the most dangerous and difficult steps in setting up the Chart of Accounts is during QuickBooks setup, especially for contract service-based businesses. Get this one thing right, and your QuickBooks for contractors can generate useful financial and job costing reports. If you get it wrong, you will never get useful reports, no matter who handles your contractor's bookkeeping services needs. The reports you do get could lead you to make decisions based on insufficient information that could destroy your entire construction company.

A thought

Understanding your Cost of Goods Sold isn't just an accounting exercise—it's the foundation for business success. Calculating and tracking COGS effectively will empower you to make better pricing, profitability, and growth decisions.

Why struggle with numbers when you can partner with someone who lives and breathes construction accounting? Freeing up your time lets you focus on growing your business. You are never too small for us to help, and we can help you begin with your first day in business.

I am looking forward to being of assistance.

About The Author:

![]() Sharie DeHart, QPA, is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or [email protected]

Sharie DeHart, QPA, is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or [email protected]